Buying a home can be exciting and stressful at the same time, especially for the first-time homebuyer. Here are some tips to help you through a complicated p…

Video Rating: 4 / 5

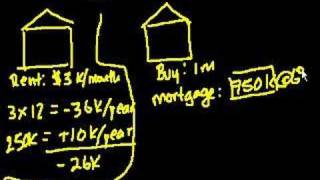

More free lessons at: http://www.khanacademy.org/video?v=YL10H_EcB-E The math of renting vs. buying a home. Challenging the notion that it is always better t…

@SteeleRose46: The full transcript for each video can be located within the

video description. You can also click the “cc” button on the video player

to watch the video with the closed captions running.

Great information for 1st time own buyers. My 1st time buyers 40% on their

Home Insurance Call 877-688-0979

my mom is a single parent trying to buy a home please help her out! we are

in need of help after being harassed by our recent neighbors at the place

we rent at. she’s decided to buy a house and isn’t sure how much in loans

we will get. any amount helps us thanks a bunch

http://www.gofundme.com/metzfam

First time homebuyer tips

First time homebuyer tips.

First Time Homebuyer Tips

First time home buyer? Here are some tips. http://bit.ly/1dJKD99

Homes used to be fairly good investments. Many couples bought their homes

early in their marriage and when they retired, sold it and bought a place

where they retired cash. Having a very low or no mortgage payment while

retired should be on everyone’s plan.

Today, the only reason I would purchase a home is to be able to deduct part

of the “housing expenditure” on my taxes. I rent a condo for $1,700/mo. The

deductible portion of the rent is minimal. The same monthly payment could

be for a house or owned apartment including property taxes, insurance, and

mortgage payment. The other thing to consider is maintenance of a house

which could be costly depending on the size and age of the building.

Great video on first time buying….

Are you a first-time homebuyer? Check out this video of things you’ll need

to know!

Tips for First-Time Home Buyers!! Great Video for potential buyers!

#firsttimehomebuyer #1sttimehomebuyer #1sttimebuyers #mortgage

Why would you take advice from a realtor who has a vested interest in you

paying as much as possible for the house? Why would they have any reason to

give you sound guidance when the more you spend, the more they make. It’s

akin to trusting the used car salesman. And as soon as the bank cuts the

check, the money is theirs, even after you default on your NINJA loan.

Snore…just rent and stop it.

Are you a first-time homebuyer? Check out this video of things you’ll need

to know!

There are a lot of issues to renting versus buying. If you are wanting a

yard for you pets, children or exercise, 1 consideration. Are you planning

to be a mover & shaker, or pretty much settled for the long term? Buying a

house doesn’t make sense if you expect to be mobile. If your employer will

pay for your move & give consideration to offset losses, etc- not so much

of an issue. If you have a hobby that requires space, such as woodworking,

car restoration, boats, campers etc-home ownership is likely necessary.

When buying a house look at schools, neighboring homes, any covenants, have

an independent inspection, lots of common sense needed. Use friends, family

& internet searches. Even though mortgage rates are up, I still consider

them a bargain. You are not only making the biggest investment you will

probably make, you are buying freedoms, making memories, having something

to call your own. Again, timing is important: are you ready, can you afford

it, can you do repairs or want to learn? Our first house was bought when

interest rates were 12 percent. As for paying for your home, lots of ways

to trade your way up, pay extra each month, make your own improvements, buy

an undervalued property, etc.

After WWII purchasing a home was a no brainer for bankers,sellers,and

buyers.

It’s very simple.In 1950 the population was 150 million.Today it is twice

as large.

Then in 2007 something shocking happened:home prices fell and did not rise.

At the same time, the Fed dropped interest rates to stimulate home and

farm sales.

Bank margins shrank as banks could not pay higher interest to savers.

Interest on bonds dropped as well making the life of saving a tough

choice,especially after the stock market cratered,as frantic debtors began

cashing out their collateral in mortgages.

Many large investors could however count on the creation of more households

through the soaring divorce rates.But these divorce rates peaked,then

stabilized.

The massive shift toward computers, the loss of jobs in construction,and

the surplus of highly educated workers created lower buying power.

These created this present recession,despite the favorable demographic

swings.

These are not easy to overcome for they are systemic changes,and a subsidy

once given cannot be reversed.,and the dream like accounting practices

which grew up during this constant housing inflation became real within the

public domain,a foolish and ultimately very frightening burden of unfunded

liabilities means many people will watch their pensions gradually

disappear,or states and federal government will print funny money.

If you look close this video is made by “Chase Bank”

Beware of anyone who tells you the “first step” toward financial freedom,

is going $200,000 into debt. With interest ;)

Tips for First-Time Home Buyers!! Great Video for potential buyers!

#firsttimehomebuyer #1sttimehomebuyer #1sttimebuyers #mortgage

Some things are unique to India 🙂

Also, the peace of mind of not having to shift every 11 months 🙂 and not

having to pay the ever increasing rentals. I would any day want to “own” a

house than rent a house. Especially when I plan to stay there for > 5 yrs.

Rental values in India don’t fall, people just hold on to investments even

when its not generating income. Which is creating a bigger bubble.

It’s 6% for 30 years not for every year you knit whit

That 1m dollar house is worth 1.2 in 2011. He could have lived in it for

free and then made some. Now its like 1.3-1.4m ….koodos

To me the part that was not shown was what you could do with the 250k and

how that could generate income to pay the 3k rent easily and reduce your

taxes and grow in value. It really is not that hard to get a 15-20% ROI if

you know what you are doing. And I am not talking about the stock market.

MOST people really have no business “buying” a home to live in. It’s all

about financial literacy. Something that is sorely lacking today. That is

why most people buy and are financial slaves.

There is no way that a CD today will yield 4%, also 6% is probably high for

a mortgage in recent years.

Rent goes up over the time too. I want to know over 30 years how much

interest are disappeared to bank. Also how much maintenance is out of the

pockets. Even if I sold the house. Gained the appreciation, where do I move

to? A futher away place? A smaller place?

After the 30 years the owner should have paid off the 750k and owns the 1

million dollar home. And after 30 years that house could be worth 2 or 3

million. Where as the renter has an extra 25k a year (25k x 30 = 750k) in

the bank, even with accumulated interest wouldn’t even be close to the

value of owning a million dollar property after 30 years. Property may drop

in short term but not after 30 years.

This video was very very smart in 2008 :)

1) Rent goes up year to year, mortgage payment does not. 2) Rent for the

same property is going to be higher than the monthly mortgage payment (the

landlord is looking to make a profit, so higher than his mortgage, prop

taxes, insurance, and maintenance/repairs)

Not a fan of this example for a couple reasons:

a) the interest rates chosen support the bias in this argument

b) the apartment and home prices chosen also support the bias in this

argument

I just checked deposit rates at a credit union and as I thought, no one is

getting anywhere 4% returns on deposits. More like “.4%”.

Also checked bankrate for rates on a 1M mortgage with 25% down. The rates

returned range between 4.37% and 4.57%.

Inflation will cause rent to increase annually whereas a fixed rate

mortgage is unaffected by inflation. Inflation will also cause the value of

your house to increase annually. If this person is willing to sacrifice

commute time for a lower purchase price, the rest of these factors makes

this a no-brainer -> own.

30 years of rent is lost eternally. 30 years of mortgage payments can be

sold, and at a minimum, you’d break even (unless something like what

happened in Detroit happens).

NOTE: Insurance covers big ticket expenses like roof damage caused by

storms, floods caused by weather or rusted water heaters, broken windows,

and other unforeseen things. Owning is better assuming you do your homework

on prices, rates, and insurance.

I used a value of 4% interest and the difference in the end was $500. Add

in the equity in your home and it seems that buying is the clear winner.

Plus, after 30 years the home should appreciate in value. I guess the

lesson is to not get a home loan with an atrocious interest rate like 6%?

I see a lot of people criticizing this video but take a look at the date

this was uploaded. This was about 6 months before the big crash that caused

millions lose their homes. If he had listened to everyone he would have

been devastated. Instead he waited and likely got a fantastic deal on one

of the many houses that were foreclosed.

This Video is made on 2008 when housing Market is in a booon. When the

Market crashed the following years that same property is in Market for 60%

less. Now do the math

why not just buy a house for 250k lol you dont need a million $ house just

get some cute smaller one

Will people ever learn from the poverty of america?

People lose their jobs and suddenly cant pay the mortgages on their homes.

The end up homeless. Then what? Start renting of course..

personally buying is better. BUt if you add up maintance roof repairs and

plus mortgage that’s a lot.

What about inflation?